Property taxes

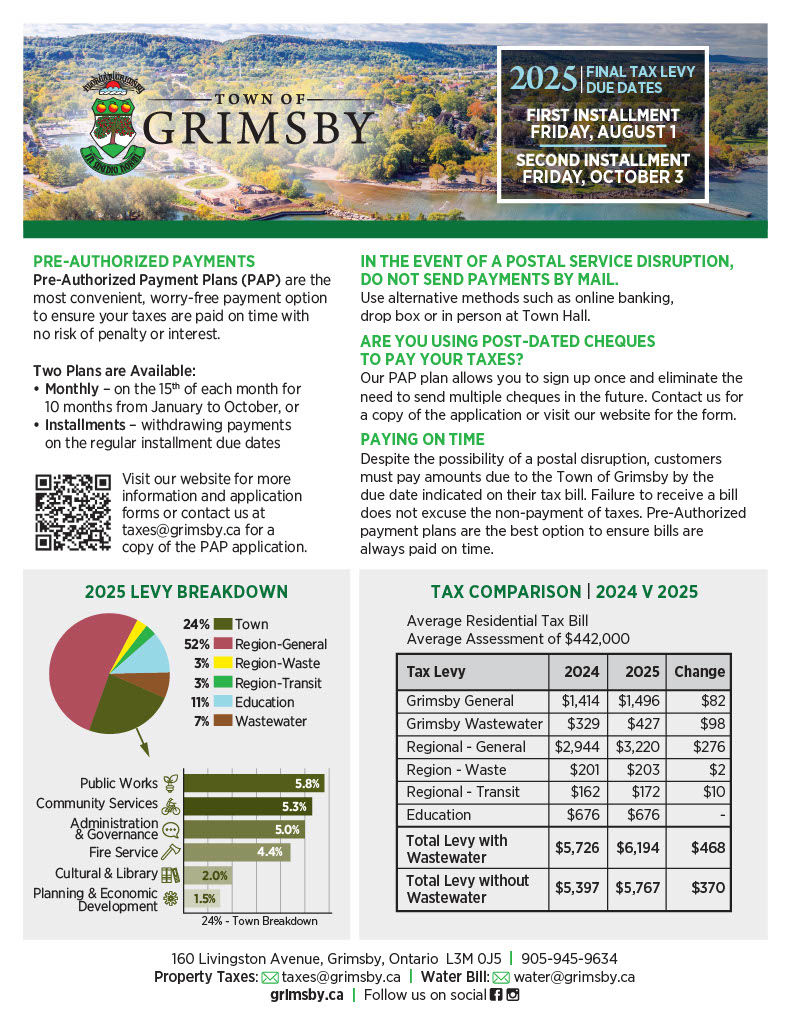

Property taxes provide the main source of revenue to deliver services supplied by the Town of Grimsby, the Niagara Region and the local school boards.

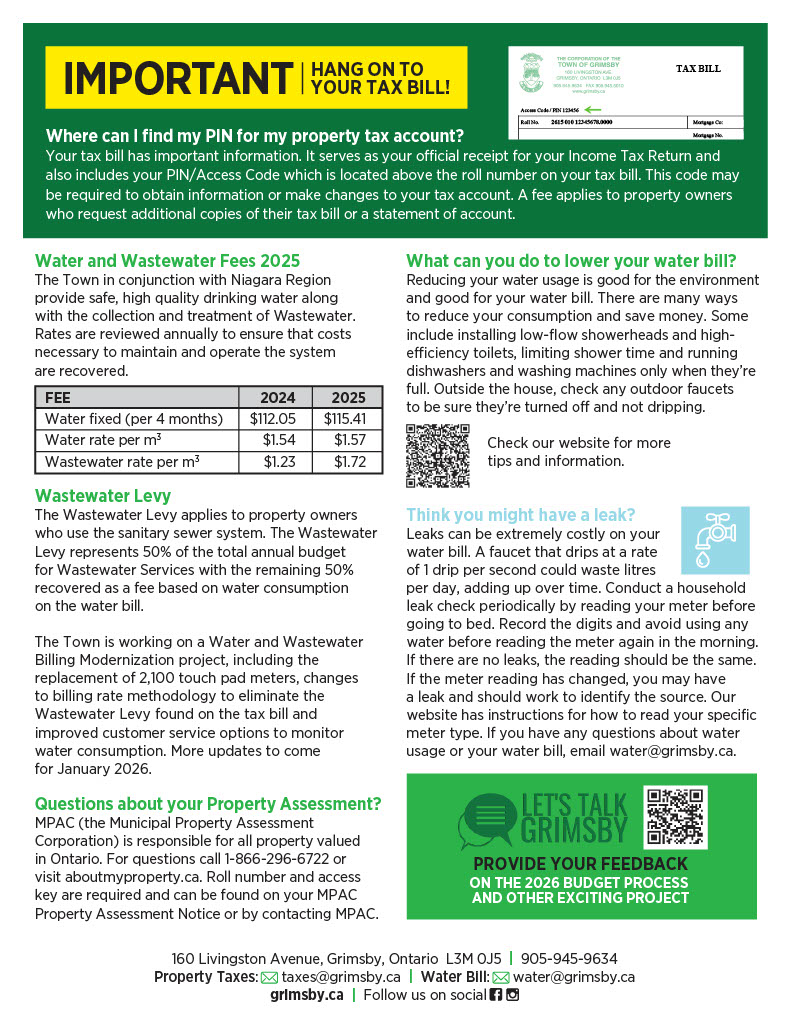

Tax bills

Residential and commercial property owners receive a tax bill which includes their property tax class, property assessment and tax rates. We mail two tax bills to all property owners – an interim bill and a final bill. We mail the interim bill in February and the final tax bill in July. Each tax bill has two installment due dates.

Paying your property taxes

Learn about the many payment options we have available and how to set up a pre-authorized payment plan.

Have a question?

If you have questions about your tax bill, please contact the town's tax department.

2025 Tax Bill Flyer

Contact Us

Town of Grimsby

Finance Department - Property Taxes

160 Livingston Avenue

Grimsby, ON L3M 0J5

Phone: 905-945-9634

Fax: 905-945-5010

Email: taxes@grimsby.ca

Sign up to stay up to date with news from the Town of Grimsby

Stay up to date on the Town's activities, events, programs and operations by subscribing to our News Alerts.